Definition & Example

A token is a representation of an asset or bundle of rights that can be issued, traded, distributed and tracked on a blockchain [1].

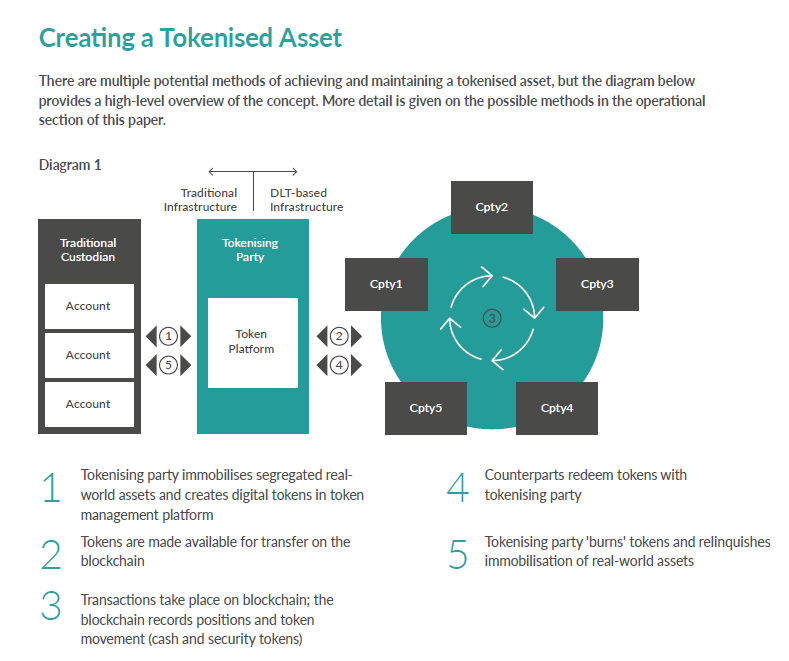

There are two main activities that are meant when the term tokenisation is used in securities markets at time of writing:a) Tokenised Assets. Tokens that represent ownership of an existing asset or bundle of rights, such as bonds, stocks, other types of securities, real estate [2], artwork, or even tractors [3]. These tokens can be traded on a blockchain platform, providing increased mobility and fractional ownership.For example, tokenising bonds can enable investors to buy and sell fractions of bonds, allowing for greater liquidity by providing accessibility to a wider range of investors. Tokenising custodied assets, such as gold, can enable investors to hold fractional ownership of the asset without the need for physical custody or storage. This raises the possibility of these tokens being borrowed, lent, and used as collateral in a similar way to traditional securities.Datonomy [4], which classifies digital assets, further breaks down this category into:

- "Asset-Backed Tokens: Tokenized assets that are backed by other assets, such as cryptocurrencies, securities, or commodities. The underlying assets backing these tokens are typically held in a segregated account on or off-chain."

- "Synthetic Tokens: Tokens that mimic the one-to-one value or price of another asset, such as cryptocurrencies, securities, or commodities. These tokens provide exposure to a particular asset without having to hold or own the asset itself.”

Tokenising some currently indivisible assets such as real estate, is effectively akin to securitisation, whereas for divisible assets such as bonds the tokenisation process is simply the transformation to reside electronically on a blockchain.

b) Natively Digital Issuances. This involves creating tokens that represent ownership of a new security, such as equity or debt, that is natively digital and issued on a blockchain. These tokens can be sold in security token offerings (STOs), providing investors with a new way to participate in capital raising and ownership. Native digital issuances have accelerated, with digital bond issues announced denominated in CHF [5], EUR and GBP [6], amongst others.

These two forms of tokenisation are largely treated separately at the current time, but it is likely that in the future their usage will converge. Some issuances also combine digital and traditional issuance characteristics [7].

-

[1] Available here.

-

[2] See here for example.

-

[3] Sandner, P. (2022) Tokenization of Industrial Goods: 'Tractor-as-A-token', Forbes. Forbes Magazine. Available here. [Accessed: February 27, 2023].

-

[4] Available here.

-

[5] Six (2021) Six launches its six digital exchange by successfully issuing the world's first digital bond in a fully regulated environment, SIX. SIX. Available here. [Accessed: February 27, 2023].

-

[6] EIB (2023) EIB issues its first ever digital bond in Pound Sterling, European Investment Bank. European Investment Bank. Available here. [Accessed: February 27, 2023].

-

[7] Hong Kong Monetary Authority (2023) Eddie Yue on tokenised bond: Huge potential to be unlocked, Hong Kong Monetary Authority. Available here. [Accessed: February 27, 2023].