Definition & Example

Central Bank Digital Currencies (CBDC) are digital fiat currencies, or digital cash. They are similar to cryptocurrencies with key differences being that CBDC is centralised, controlled and backed by the state. [1] This is in contrast to cryptocurrencies which are usually decentralised, or, where they are centralised, are controlled by a non-sovereign commercial company. A CBDC represents a claim on the central bank and there are two types of CBDC to consider: retail and wholesale.

Retail CBDCs are made available to the general public, acting like traditional cash in day-to-day transactions, just as a banknote is a claim on the central bank. As noted by the BIS [2], there are two variants of implementation for retail CBDC: a) anonymous transactions through use of passwords and digital signatures, protecting the privacy of the “user” and b) transactions verified by a form of digital identity. The latter would allow for better visibility of authorities over fraudulent and criminal activity. Privacy of a consumer, in terms of details shared with any commercial supplier could still be protected in such a system based on data sharing permissions and existing data privacy laws [3]. However, there are those who are concerned about the opportunity for surveillance by governments [4][5].

Of more relevance to the securities financing industry, distinct from retail CBDC (rCBDC) is the wholesale CBDC (wCBDC). wCBDCs would be available only to financial institutions, with the intention of being used in large scale settlement between banks and other Financial Management Information Systems (FMIS). This is similar to holding reserves at the central bank as it works today [6].

CBDCs are thus effectively simply another distribution/utility method for fiat cash, and it is envisioned, including by the ECB [7] that CDBCs will coexist with other forms of central bank currency. This no doubt will have its challenges. One key difference would be that, being natively digital, there is the possibility of embedding conditions of use and other behaviours into the currency, a property leading to CBDCs being referred to as “programmable money” [8]. For example preventing use with certain retailers, say gambling outlets, or in the case of wCBDC preventing use with certain countries or institutions on sanctions lists. This would be inherent to the currency and therefore reduce the need for multiple checks and balances, often of a manual nature, in place at financial institutions today. Again, concerns over misuse of this power to "program" the money would need to be addressed by any state introducing the CBDC.

According to the Atlantic Council [9] 114 countries were exploring a CBDC of some form as at June 2023. This is a 300% increase on the figure three years prior. Global geopolitical and economic uncertainty, such as financial sanctions arising from the conflict in Ukraine, and the resulting desire of some countries to avoid being systemically tied to the US dollar, and some countries to better control the flow to sanctioned entities, is one major factor in this growth. Another is the opportunity afforded to emerging economies who can see the benefit of digital distribution methods to reach their unbanked populations, a possibility outlined by the IMF looking at financial inclusion in March 2023 [10]. Indeed, of the 11 countries listed as having launched a CBDC as of June 2023 all are retail based and located in the Caribbean or Africa.

Of the 29 countries listed as looking at CBDC at the time this briefing note was drafted, 11 are in pilot mode, including China [11], India [12], Australia [13] and South Africa [14]. Those listed as in the development stage include the United States [15], Canada [16], UK [17] and the EU [18]. Whilst 91% of the launched CBDCs operate on DLTs [19], those in pilot or under development show a wider spread of potential technology solutions to providing CBDC.

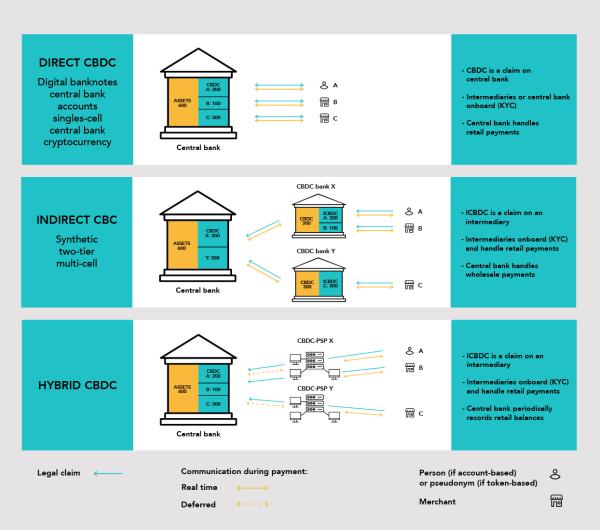

There are also three models of architecting a CBDC: direct, indirect and hybrid. These models are laid out in the below picture [see 'In Pictures'] [20], and differ in terms of the degree of separation between the end user/user firm of the CBDC and the central bank itself. Again, those in pilot or under development are exploring different models of implementation. One of the better-known uses of the synthetic, or indirect, model is Fnality’s [21] Utility Settlement Coin (USC). The project facilitated the first cross-chain repo swap pilot in 2022 [22].

-

[1] Available here.

-

[2] III. cbdcs: An opportunity for the monetary system (2021) The Bank for International Settlements. Available here. [Accessed: 05 June 2023].

-

[3] Middleton, P. (2022) How real is the CBDC threat to privacy?, OMFIF. Available here. [Accessed: 05 June 2023].

-

[4] Hall, J. (2023) UK think tank launches a crusade against ‘surveillance’ cbdcs, Cointelegraph. Available here. [Accessed: 05 June 2023].

-

[5] Kynge, J. and Yu, S. (2021) Virtual control: The agenda behind China’s new digital currency, Financial Times. Available here. [Accessed: 05 June 2023].

-

[6] Giuliani, G. (2021) The banking system, a giant settlement infrastructure, Fintech Ruminations. Available here. [Accessed: 05 June 2023].

-

[7] European Central Bank (2023) FAQs on the digital euro, European Central Bank. Available here. [Accessed: 05 June 2023].

-

[8] Lee, A. (2021) What is programmable money?, The Fed - What is programmable money? Available here. [Accessed: 05 June 2023].

-

[9] Central Bank Digital Currency tracker (2023) Atlantic Council. Available here. [Accessed: 05 June 2023].

-

[10] Tan, B. (2023) Central Bank Digital Currency and financial inclusion, IMF. Available here. [Accessed: 05 June 2023].

-

[11] Available here.

-

[12] Available here.

-

[13] Available here.

-

[14] Available here.

-

[15] Available here.

-

[16] Available here.

-

[17] Available here.

-

[18] Available here.

-

[19] Distributed ledger - Isla Digital & Fintech (2022) ISLA. Available here. [Accessed: 05 June 2023].

-

[20] Picture sourced from here.

-

[21] Available here.

-

[22] Office, F.P. (2022) Fnality and HQLAX demonstrate the first cross-chain repo swap pilot, Fnality International. Available here. [Accessed: 05 June 2023].