Page 11 - ISLA_SLReport_Aug2020_double

P. 11

were developed to deal with a single 9/11 style of As Europe pushes ahead with its own Capital Markets

event, had to be adapted. This led in turn to pressure Union (CMU), it too will have to consider how it thinks

on key project management and IT resources that about supporting markets more broadly.

were taken away from deliverables such as SFTR, to

As our infrastructure was maintain business continuity and support the new and The recent short selling bans seen in some parts of The value of securities

tested to its extremes, with diverse way in which major firms were operating. Europe would appear to be inconsistent with the wider in lending programmes

ambitions of the CMU, as Europe strives to emulate the

at times 40%+ additional After due consultation across the industry and with economic benefits of market-led capitalism. fell significantly at the

trading volumes and the regulatory community, we did see some level of Not unexpectantly as events unfolded in late February end of February and

forbearance with specific extensions given, particularly

thousands of attendant around SFTR which was due to go-live at the height of and into March and April, these macro themes played into March, as equity

margin movements, the the crisis. The extension of the implementation date out in our markets and influenced many of the metrics markets reacted to

that we routinely follow.

for the reporting obligations under Article 4 of the

operational framework SFTR to mid-July, was used wisely by firms to focus on COVID-19 concerns

around the industry more rigorous end-to-end testing to put the industry We have discussed before how much of the data we

in a better position as this important reporting regime

collect from our data partners is value rather than

performed well began on the 13 July. volume based, which means that during periods of

extreme market volatility, the volatility component

Another factor which we probably have to thank of any analysis could mask actual changes within our unchanged from six months earlier, at circa €20 trillion.

the regulatory community for, is that during this markets. We have highlighted how the first six months This simple comparison however, fails to highlight the

manifestation of market turbulence, we did not see any of 2020 saw some unprecedented movements in considerable falls in equity markets that led to falls in

significant counterparty defaults. Since the 2007/08 equity markets, and as we look further at securities the value of securities held in lending programmes.

Time and history will tell us if the furlough schemes crisis, banks have been required to steadily hold higher lending markets in particular, we have to take these

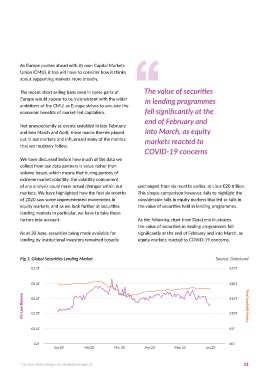

fundamentally put a floor under any post-COVID levels of tier one capital, as regulators demand higher factors into account. As the following chart from DataLend illustrates,

recession, or merely delayed the inevitable. levels of regulatory capital to support trading and risk the value of securities in lending programmes fell

businesses. This has meant that banks have been able to As at 30 June, securities being made available for significantly at the end of February and into March, as

As we enter the summer period with overseas holidays withstand both operationally and structurally the recent lending by institutional investors remained broadly equity markets reacted to COVID-19 concerns.

being contemplated by the very few, markets appear to market shocks, and emerge relatively unscathed.

have stabilised regaining many of the losses seen during

the depth of the crisis in March and April. Taking stock The idea that financial crises tend to revolve primarily Fig 1: Global Securities Lending Market Source: DataLend

on the first six months of this year and how securities around banks and other prudentially regulated entities, €2.5T €25T

lending fared during this period, the overall feeling from seems suddenly dated as systemic risk appears to have

across our industry is one of stability and resilience. Whilst shifted from these traditional intermediaries to the

our infrastructure was tested to its extremes, with at markets themselves. This in turn raises some interesting €2.4T €20T

times 40%+ additional trading volumes and thousands of questions about how regulators and other policy makers

attendant margin movements, the operational framework respond to these changing dynamics. As mentioned €2.3T €15T

around the industry performed well. previously, the Fed in North America appears to have On-Loan Balance Total Lendable Assets

shifted its emphasis to support broader market liquidity €2.2T €10T

The current crisis also bought with it other challenges rather than specific institutions. In the immediate

that could not have been anticipated. As governments aftermath of the 2007/08 crisis, Mark Carney, the €2.1T €5T

imposed increasingly restrictive lockdowns, banks incoming governor of the BoE talked about not wanting

suddenly had to learn how to support their workforces to see taxpayer money ever being used again to bail out

working remotely, as business contingency plans that the banks. Arguably that objective has been achieved. €2T Jan 20 Feb 20 Mar 20 Apr 20 May 20 Jun 20 €0T

10 * See Data Methodologies for full details on page 50 11