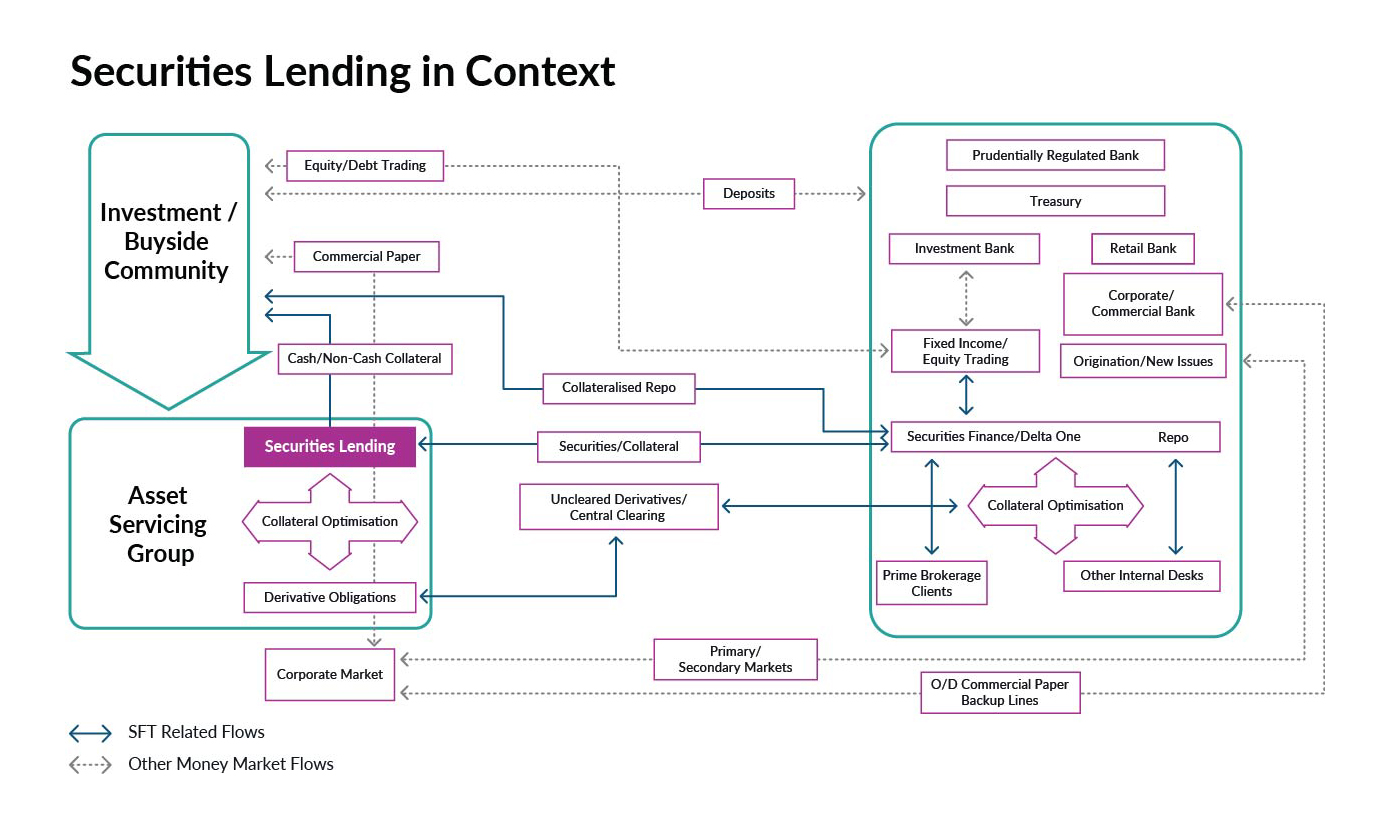

Securities lending and borrowing is where an investor temporarily lends securities to a borrower, in return for a fee. It is one of four different securities financing transaction (SFT) types, along with repurchase transactions (repos), buy-sell back transactions and margin or commodity lending.

Securities that are lent can be in the form of bonds issued by governments or corporates, as well as equities. In addition to the fee, the borrower provides the lender with collateral in the form of cash or other securities. This protects the lender from the risk of potential loss if the borrower becomes insolvent and is unable to return the lender’s securities. The value of the collateral provided by the borrower is normally greater than the value of the borrowed securities, providing additional protection for the lender. To further protect both parties from market fluctuations during the life of the transaction, securities and collateral on loan are revalued on a daily basis and adjusted if needed. At the end of the transaction the borrower and lender return their respective securities and collateral to one another.

Securities are frequently lent on an open basis and as such, can be recalled if the lender requires the securities back. These requirements form part of market standard legal agreements, and the processes are further supported by widely accepted best practices between market participants.

This activity is often usually conducted by a lending agent, for example a custodial bank, a third-party lender or an in-house lending affiliate acting on behalf of the lender, often referred to as a beneficial owner. This is known as the supply-side.

Agents are frequently used by lenders as securities lending tends to be a high volume and short term discretionary activity and does not form part of the main activity of institutional investors. However, some lenders may choose to lend directly (i.e., not appoint an agent) whilst others may choose to utilise multiple providers, lend assets through both a custodian and a third-party agent, or a combination of the above. Borrowers and end users of the lent securities are known as being on the demand-side.

Borrowers are typically large financial institutions such as investment banks and broker dealers. These institutions borrow securities to support their own proprietary trading, market making and to facilitate short coverage for their clients such as alternative investment managers and hedge funds, who are referred to as underlying borrowers.