Page 29 - 2516_21_June_ISLA_Market_Report_-_June_2021_-_final

P. 29

28 29

Securities Lending Market Report | June 2021

Collateral Dynamics

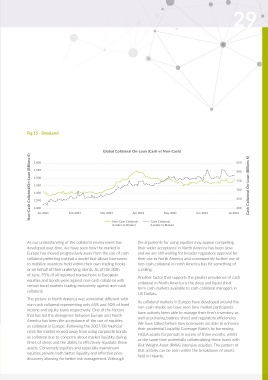

As our markets have grown and evolved the role of collateral has also changed. From simply being a risk mitigant Fig 15 - DataLend

against loss in the event of a counterpart default its form and composition can now, in many cases, define the

economics of a trade. Prior to the 2007/08 crisis we saw how expansive cash collateral reinvestment programmes

could be used to drive overall performance. Looking back with the benefit of hindsight it is unlikely that Global Collateral On-Loan (Cash vs Non-Cash)

programmes structured in this way would be seen as desirable by today‘s risk averse standards. Today, a different

set of fundamentals and drivers increasingly determine the way we think about collateral. 1,600 850

As other markets and products demand greater and more astute use of collateral, we may see an increasing desire 1,550

to try and optimize the use of collateral on a cross product basis, although the operational and legal challenges of 800

doing this should not be underestimated. The investment in infrastructure, systems and legal support needed could 1,500 750

be prohibitive especially if desired outcomes around areas such as capital usage are not certain. Non-Cash CollateralOn-Loan (Billions €) 1,450 Cash Collateral On-Loan (Billions €)

We have been tracking the development of collateral usage as part of our Securities Lending Market Reports for 1,400 700

several years and as at the 30th June we saw some 66% of all loans collateralized with other securities (non-cash) 1,350 650

and 34% being collateralized with cash collateral. 1,300 600

May 2021

Jan 2021

Apr 2021

Feb 2021

Mar 2021

Non-Cash Collateral Cash Collateral Jun 2021 Jul 2021

(Lender to Broker) (Lender to Broker)

As our understanding of the collateral environment has the arguments for using equities may appear compelling

developed over time, we have seen how the market in their wider acceptance in North America has been slow

Europe has moved progressively away from the use of cash and we are still waiting for broader regulatory approval for

collateral preferring instead a model that allows borrowers their use in North America and consequently further use of

to mobilize inventory held within their own trading books non-cash collateral in north America has hit something of

or on behalf of their underlying clients. As of the 30th a ceiling.

of June, 95% of all reported transactions in European Another factor that supports the greater prevalence of cash

equities and bonds were against non-cash collateral with collateral in North America is the deep and liquid short

certain bond markets trading exclusively against non-cash term cash markets available to cash collateral managers in

collateral.

US Dollars.

The picture in North America was somewhat different with As collateral markets in Europe have developed around the

non-cash collateral representing only 65% and 50% of fixed non-cash model, we have seen how market participants

income and equity loans respectively. One of the factors have actively been able to manage their firm‘s inventory as

that has led the divergence between Europe and North well as pursuing balance sheet and regulatory efficiencies

America has been the acceptance of the use of equities We have talked before how borrowers are able to enhance

as collateral in Europe. Following the 2007/08 financial their prudential Liquidity Coverage Ratio’s by borrowing

crisis the market moved away from using corporate bonds HQLA assets for periods in excess of three months, whilst

as collateral due to concerns about market liquidity during as the same time potentially collateralizing those loans with

times of stress and the ability to effectively liquidate these Risk Weight Asset (RWA) intensive equities. The pattern of

assets. Conversely equities and especially mainstream that activity can be seen within the breakdown of assets

equities provide both better liquidity and effective price held in triparty.

discovery allowing for better risk management. Although