Page 13 - 2516_21_June_ISLA_Market_Report_-_June_2021_-_final

P. 13

12 13

Securities Lending Market Report | June 2021

Equities

>>> Europe >>> Asia Pacific

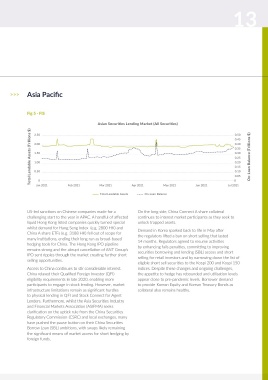

Fig 4 - IHS Markit Fig 5 - FIS

European Securities Lending Equity Market 0.30 2.50 Asian Securities Lending Market (All Securities) 0.50

Total Lendable Assets (Trillions €) 3.00 0.25 On-Loan Balance (Trillions €) Total Lendable Assets (Trillions $) 2.00 0.40 On-Loan Balance (Trillions $)

3.50

0.45

2.50

0.35

0.20

1.50

0.30

2.00

0.15

0.25

1.50

1.00

0.20

0.10

0.15

1.00

0.10

0.50

0.05

0.50

0.05

0.00

0

0

0

Jan 2021

Feb 2021

Mar 2021

May 2021

May 2021

Total Lendable Assets

Total Lendable Assets Apr 2021 On-Loan Balance Jun 2021 Jul 2021 Jan 2021 Feb 2021 Mar 2021 Apr 2021 On-Loan Balance Jun 2021 Jul 2021

EMEA equity lending saw mixed performance over the Seasonal demand for record date securities was markedly US-led sanctions on Chinese companies made for a On the long side, China Connect A share collateral

first half of 2021. up this year compared to 2020 as companies resumed and challenging start to the year in APAC. A handful of affected continues to interest market participants as they seek to

increased dividend pay-outs. Scrip dividend values are up liquid Hong Kong listed companies quickly turned special unlock trapped assets.

GC balances were up 48% year over year (YoY) and, in YoY but still down over 50% since 2019. That said, the whilst demand for Hang Seng Index (e.g. 2800 HK) and

absolute terms, are the highest we have seen in at least spread between the cash and stock elections on UK REIT China A share ETFs (e.g. 3188 HK) fell out of scope for Demand in Korea sparked back to life in May after

three years. However, warms and specials as a percentage Hammerson in April created one of the largest revenue many institutions, ending their long run as broad-based the regulators lifted a ban on short selling that lasted

of the loan book were down significantly as corporate opportunities of the year so far. hedging tools for China. The Hong Kong IPO pipeline 14 months. Regulators agreed to resume activities

activity remained mooted and exposure to companies remains strong and the abrupt cancellation of ANT Group’s by enhancing fails penalties, committing to improving

hit hardest by COVID-19, such as the retail, travel and Continued tax harmonisation in Europe led to reduced low- IPO sent ripples through the market creating further short securities borrowing and lending (SBL) access and short

entertainment sectors, were reduced as vaccination dividend supply in some markets, particularly France and selling opportunities. selling for retail investors and by narrowing down the list of

programmes were rolled out globally. Italy, where more beneficial owners are now able to receive eligible short sell securities to the Kospi 200 and Kospi 150

their dividends free of withholding tax. Access to China continues to stir considerable interest. indices. Despite these changes and ongoing challenges,

Despite the lack of activity, when companies did come

to market to raise capital, there were good revenue Additionally, rules implemented by tax authorities in China relaxed their Qualified Foreign Investor (QFI) the appetite to hedge has rebounded and utilisation levels

opportunities for clients, such as the deeply discounted Denmark and Austria have led to rejections of tax reclaims eligibility requirements in late 2020, enabling more appear close to pre-pandemic levels. Borrower demand

rights issue by TUI (TUI LN and TUI GR) and from the by clients on securities returned by borrowers on or after participants to engage in stock lending. However, market to provide Korean Equity and Korean Treasury Bonds as

lapsed rights of Euronext (ENX FP) and Credit Suisse AGM (Denmark) or after Ex Date-1 (Austria), resulting infrastructure limitations remain as significant hurdles collateral also remains healthy.

(CSGN SW). in lenders either restricting returns around key dates or to physical lending in QFI and Stock Connect for Agent

restricting supply to avoid the risk of rejection altogether. Lenders. Furthermore, whilst the Asia Securities Industry

EMEA was not immune to the battle between retail and Financial Markets Association (ASIFMA) seeks

investors and the short sellers. The fallout from the clarification on the uptick rule from the China Securities

Reddit-led short squeeze in GameStop (GME US) in the Regulatory Commission (CSRC) and local exchanges, many

US spilled into Europe, with hedge funds closing their have pushed the pause button on their China Securities

shorts in positions with high short-interest, notably CD Borrow Loan (SBL) ambitions, with swaps likely remaining

Projekt (CDR PW) and Varta (VAR1 GR), both strong the significant means of market access for short hedging by

revenue earners at the time. foreign funds.