Page 6 - 2516_ISLA_Market_Report_-_Sep_2025_v6

P. 6

6 Securities Lending Market Report | H1 2025 7

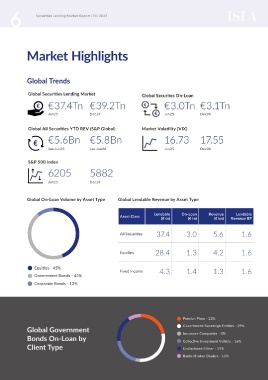

Market Highlights

Global Trends Government Bond Markets

Global Securities Lending Market Global Securites On-Loan Utilisation Securities On-Loan

€37.4Tn €39.2Tn €3.0Tn €3.1Tn 31.6% 32.4% €1.4Tn €1.5Tn

Jun25 Dec24 Jun25 Dec24 Jun25 Dec24 Jun25 Dec24

Global All Securities YTD REV (S&P Global) Market Volatility (VIX)

€ €5.6Bn €5.8Bn 16.73 17.55 Collateral

Jan-Jun25 Jan-Jun24 Jun25 Dec24

Government Bond Collateral Held in European European Non-Cash Collateral Held in

S&P 500 Index Tri-Party by Domicile of Issuers European Tri-Party

6205 5882

Jun25 Dec24

Europe - 37% Equities - 46%

Asia - 25% Corporate Bonds - 14%

Global On-Loan Volume by Asset Type Global Lendable Revenue by Asset Type North America - 26% Government Bonds - 38%

Other - 12% Other - 3%

Lendable On-Loan Revenue Lendable

Asset Class

(€ tn) (€ tn) (€ bn) Revenue BP

All Securities 37.4 3.0 5.6 1.6

Equities 28.4 1.3 4.2 1.6

Equities - 45%

Fixed Income 4.3 1.4 1.3 1.6 Equity Markets Providers

Government Bonds - 43%

Corporate Bonds - 12%

Securities On-Loan

€1.3Tn €1.2Tn

Jun25 Dec24

Pension Plans - 22%

Global Government Government/Sovereign Entities - 29% Lendable Assets

Insurance Companies - 3%

Bonds On-Loan by Collective Investment Vehicle - 16% €28.4Tn €29.8Tn

Client Type Undisclosed/Other - 19%

Jun25 Dec24

Banks/Broker Dealers - 11%