A domain model is the combination of data representation and functional representation of processes which can act on that data. Every firm will have their own domain model today, though it may not be referred to as that; actually, most firms will have multiple domain models governing the life cycle of any single trade.

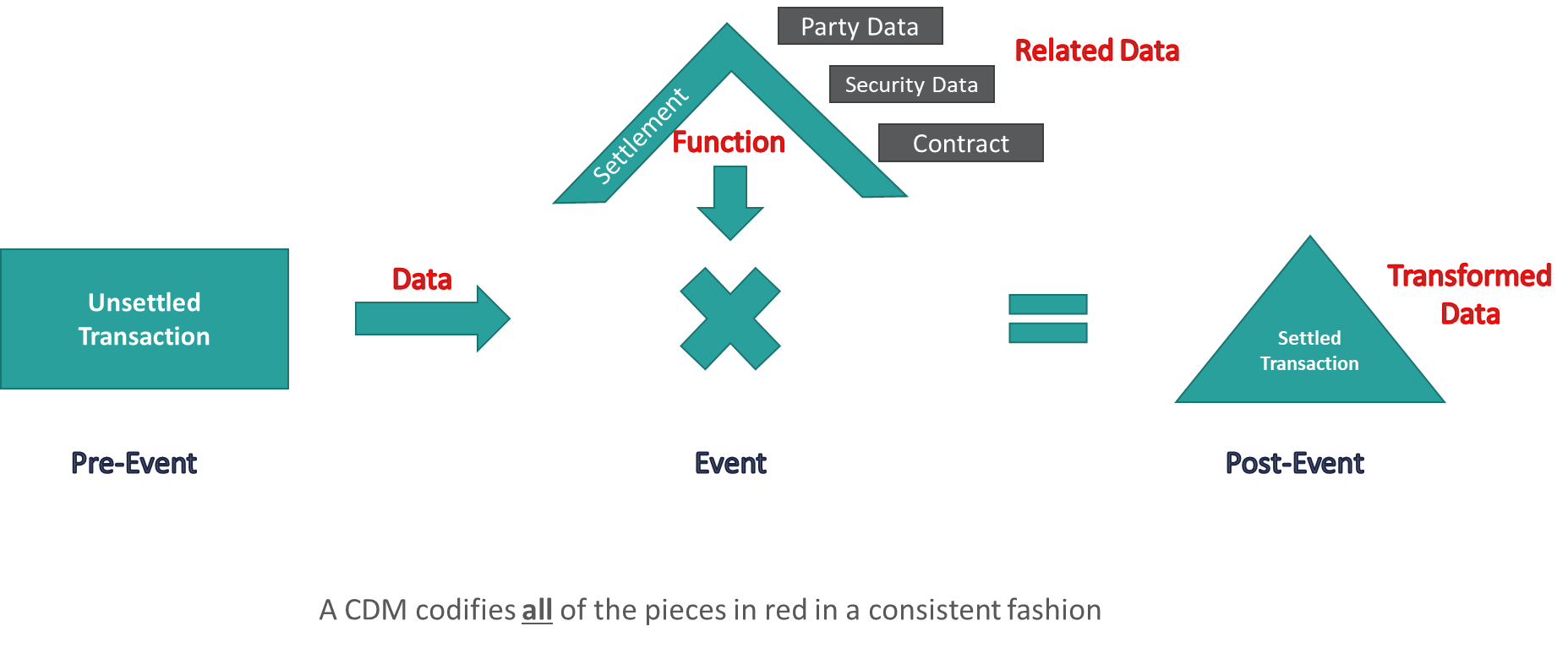

A CDM is an agreed upon, standardised domain model i.e. a standard digital representation of data and function. Importantly, the CDM is agreed upon based on real-world business outcomes, and is focused on standardising processing, not just the underlying data.

A full-CDM will integrate all aspects of a transaction including: product representation; event representation and outcome, from regular events such as billing and margining, to less frequent complex corporate actions; legal documentation impacting a transaction, such as a GMSLA or a collateral agreement; process sequencing and outcome; reference data and translation into or from other data models such as FpML.

In the short term, a CDM allows for unambiguous and consistent messaging, storage and processing of data. This simplifies many operational processes and reduces the need for reconciliations between systems or parties using the CDM.

In the longer term, having already encoded functionality, the CDM can enable the easier construction of smart contracts, faster connection to and support of a distributed ledger, and ultimately the ability for firms to innovate and compete on products, not on infrastructure or data storage.

Through the CDM members should see a substantial reduction, if not a total eradication, of:

The extent to which these benefits at any given point in time are realised is dependent on how fully the CDM has been integrated at that time. For example, to reduce collateral disputes with a counterparty, both parties must be using the CDM, or to reduce internal inter-system breaks, those systems must be using the CDM.

The CDM is a data model that provides a standard format for financial products and transactions in the capital markets industry. It is intended to improve data quality, increase efficiency, and reduce costs by creating a common language that enables automated trade processing and reduces the need for costly customisations.

The CDM not only defines a set of standardised data elements and their relationships, including details about the trade, parties involved, and cash flows, but also standardises processes, legal documentation and life cycle events.

By using the CDM, market participants can more easily exchange data with each other and across systems. Internally this will lower the risk of errors, reduce costs and enable more efficient workflows to be implemented; externally there will be smoother onboarding of new clients and allow a “plug and play” style transition between vendors.

Overall, the CDM is a crucial tool for improving data quality, flexibility, and automation in the capital markets. Its use can lead to significant benefits for market participants, such as reduced operational costs, increased efficiency[1], and improved risk management.

[1] At the CDM Showcase in February 2023 Dr Lee Braine stated that a 50 to 70% increase in efficiency could be achieved by restructuring data for interest rate swaps to use the CDM.

The CDM is a data model that provides a standard format for financial products and transactions in the capital markets industry. The common language that the CDM provides for financial products and transactions enables the seamless exchange of data between different systems, reducing errors and improving efficiency. The workflows and event management capabilities of the model provide a standard business logic, allowing all parties to a trade to guarantee compatibility and interoperability with CDM compliant systems.

The introduction of the CDM into an existing trading infrastructure can be done incrementally, providing a low-risk entry point to its broader adoption. Businesses can choose sections of the model that address their most pressing pain points, implementing tailored solutions that can be embedded into existing systems or executed as separate service layers.

Adoption of the CDM is increasingly becoming essential in the capital markets industry, and it is being supported by major industry associations including ISLA and FINOS. Its use ensures effective communication and efficient processes in the trading lifecycle, thereby enhancing risk management and operational efficiency.

When assessing solutions to improve operational efficiency and competitiveness in the industry, understanding the CDM and considering its adoption should be one of the primary tasks undertaken.

The CDM is a data model that provides a standard format for financial products and transactions in the capital markets industry. One of the key strengths of the CDM lies in its integration capabilities, being flexible enough to be embedded within new or existing applications, or leveraged as a service layer for external communications and data exchange.

This in turn simplifies software development, reducing development costs and increasing efficiency. Incorporating the CDM into internal systems as a shared data model further enhances these benefits, making it easier to communicate with other systems and reduce errors caused by mismatched data formats. This can help streamline integration efforts and lower the total cost of ownership across systems.

The standardised data elements and relationships within the CDM form the basis of a machine-readable data dictionary, helping to eliminate ambiguity, define common representations of financial instruments, and improve interoperability between different systems. The extensibility of the model allows you to incorporate your own data requirements without compromising compatibility with other systems.

Translation layers mapping the CDM to other financial data standards like FpML, FIX or ISO20022 are available out of the box, and the model can be deployed in several industry recognised programming languages (e.g. Java, Python).

Using the CDM allows you to design financial software and systems that are more efficient and easier to maintain.