Page 11 - ISLA_SLReport_Feb2021_final

P. 11

This in turn led to severe pressure on health care systems, remained at historically low levels, to provide a further their holdings), primary dealers can become swamped

with the much feared second wave being seen across stimulus to economic activity which may in part be driving with Treasuries. This in turn may lead to a point where

Europe and elsewhere. Further punitive lockdowns were stock market returns. the primary dealers involved, who are mainly prudentially

implemented by governments, and although seen by regulated banks may breach their capital requirements. The

some as overly restrictive, they are known to work at Some commentators have The combination of central bank stimulus and low interest close link between primary market making in US Treasuries

limiting further spread. argued that the disconnect rates has led to a rush of company financings. Recent and the repo market is a well understood concept, with

between the rarified worlds of press reports suggest that in the first four weeks of primary dealers using the repo market to fund their long

Early investment in large scale vaccines also appeared to 2021, companies raised some €330 billion in new debt inventory positions against cash to help manage their own

be paying off, as several different but equally effective international capital markets issuance suggesting that investors were unphased by the balance sheets and capital usage. However, when either

ones began to be approved by regulators in November. and the real-world economy, has immediate impacts of the virus and were looking past the new issuance or the Fed’s open market operations suck

As these vaccines are progressively rolled out, we increased during the pandemic, current crisis. As companies opportunistically accessed cash liquidity from the markets, it can cause a spike in

should begin to see a return to some sort of normality, with the continued rise in stock investor demand, governments also tapped into those short-term cash interest rates, effectively dislocating the

particularly when more vulnerable groups within society same institutional flows, with significant new issuance important link between these two markets. These sudden

are vaccinated, thereby reducing underlying pressures on markets very much at odds with of government bonds. Since the start of April 2020, the spikes in short term cash rates can also bleed into our

health care systems. the daily toll of job losses and US Federal Reserve (Fed) raised a net $3.3 trillion to markets driving excessive securities lending fees.

individual economic hardships. fund its stimulus programmes, expanding the stock of

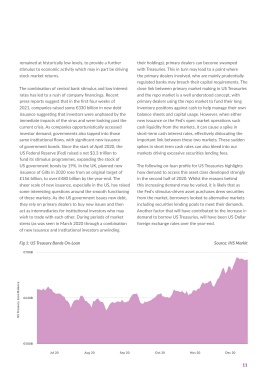

At times the second six months of 2020 felt as if US government bonds by 19%. In the UK, planned new The following on-loan profile for US Treasuries highlights

everything that we judge our lives by, was changing almost issuance of Gilts in 2020 rose from an original target of how demand to access this asset class developed strongly

daily with the media almost totally fixated on nothing but £156 billion, to over £480 billion by the year-end. The in the second half of 2020. Whilst the reasons behind

COVID. Events such as the US presidential election and investors had become more sanguine about the almost sheer scale of new issuance, especially in the US, has raised this increasing demand may be varied, it is likely that as

the UK finally leaving the European Union that would daily announcements around the pandemic, with limited some interesting questions around the smooth functioning the Fed’s stimulus-driven asset purchases drew securities

normally command significant airtime and the attention of negative impacts on either market valuations or assumed of these markets. As the US government issues new debt, from the market, borrowers looked to alternative markets

political commentators, for the most part passed almost volatility. Similarly, equity markets themselves recovered they rely on primary dealers to buy new issues and then including securities lending pools to meet their demands.

unnoticed. This apparent indifference only changed when much of their poise in the second half of the year. Using act as intermediaries for institutional investors who may Another factor that will have contributed to the increase in

we saw more extreme events around the outcome of the the S&P as a strong proxy for overall equity markets, after wish to trade with each other. During periods of market demand to borrow US Treasuries, will have been US Dollar

US elections, and perhaps then it was realised that the the period of intense volatility and short-term losses in stress (as was seen in March 2020 through a combination foreign exchange rates over the year-end.

Brexit deal was not all that it might seem. March of 2020, the value of the S&P index had grown of new issuance and institutional investors unwinding

steadily throughout the rest of the year, closing at 3756

Set against a backdrop of at times apparent chaos, it was on 31 December (some 68% higher than the lows seen in Fig 1: US Treasury Bonds On-Loan Source: IHS Markit

perhaps surprising that financial markets appeared to late March). €780B

have fared reasonably well in the second half of 2020.

During the first iteration of the pandemic in early 2020 Some commentators have argued that the disconnect

as the global health crisis developed into an economic between the rarified worlds of international capital

one, we saw unprecedented levels of market volatility, markets and the real-world economy has increased during

including eight consecutive days when equity markets the pandemic, with the continued rise in stock markets

moved by more than 5%. On March 16, the VIX, the very much at odds with the daily toll of job losses and

globally recognised index of the markets expectation individual economic hardships. This idea is perhaps where

of future volatility peeked at 85. This led directly to the more recent market disruption around GameStop has US Treasury Loan Balance €640B

significant intervention measures from central banks and its origins, as the so-called populist movement against Wall

governments, as they moved quickly to restore confidence. Street has gained both momentum and media attention.

The picture in the second half of the year was somewhat As governments grapple with trying to balance the very

different. The VIX closed the full year at 30 and had real need to control the pandemic with the desire to

traded in a range of between 20 and 40 throughout the grow economies again, we have seen further intervention

second half of 2020 (at the time of writing, it is at circa in the form of quantitative easing, with central banks €500B

20). Perusal of the VIX during this period would suggest pumping liquidity into the markets. Interest rates have also Jul 20 Aug 20 Sep 20 Oct 20 Nov 20 Dec 20

10 11