Page 22 - 2516_21_June_ISLA_Market_Report_-_June_2021_-_final

P. 22

22 23

Securities Lending Market Report | June 2021

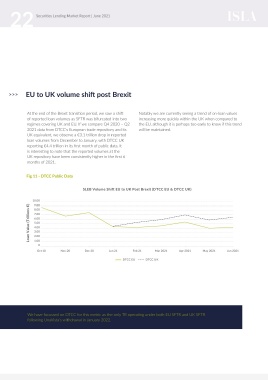

>>> EU to UK volume shift post Brexit

At the end of the Brexit transition period, we saw a shift Notably we are currently seeing a trend of on-loan values

of reported loan volumes as SFTR was bifurcated into two increasing more quickly within the UK when compared to

regimes covering UK and EU. If we compare Q4 2020 – Q2 the EU, although it is perhaps too early to know if this trend

2021 data from DTCC’s European trade repository and its will be maintained.

UK equivalent, we observe a €3.1 trillion drop in reported

loan volumes from December to January, with DTCC UK

reporting €4.4 trillion in its first month of public data. It

is interesting to note that the reported volumes at the

UK repository have been consistently higher in the first 6

months of 2021.

Fig 11 - DTCC Public Data

SLEB Volume Shift EU to UK Post Brexit (DTCC EU & DTCC UK)

10.00

9.00

Loan Value (Trillions €) 7.00

8.00

6.00

5.00

4.00

3.00

2.00

1.00

0

Oct 10 Nov 20 Dec 20 Jan 21 Feb 21 Mar 2021 Apr 2021 May 2021 Jun 2021

DTCC EU DTCC UK

We have focussed on DTCC for this metric as the only TR operating under both EU SFTR and UK SFTR

following UnaVista’s withdrawal in January 2022.