Introduction

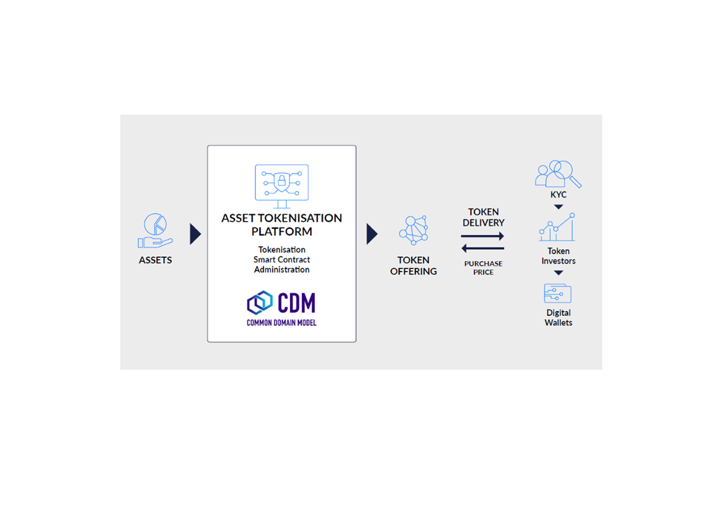

The Common Domain Model (CDM) is an open-source model hosted by the Fintech Open-Source Foundation (FINOS). It is a standardised, machine readable, and machine-executable model that represents financial products, trades in those products, and the lifecycle events of those trades. The model delivers a standardised framework designed to enhance the efficiency and interoperability of financial services, particularly in the context of regulatory reporting and data management. As the CDM provides common definitions and structures for financial data and processes, it plays a crucial role in building resilience, reducing risks, and improving efficiency within financial markets and institutions.

Hosted by FINOS and developed through their Community Specification open governance process, the CDM is an open market standard available to all. Maintained by financial professionals and trade associations (ICMA, ISDA and ISLA), the standard is continually being expanded and improved by the financial community.